This project analyzes customer churn behavior for a telecom company using Power BI, Excel, Power Query, and DAX.

The goal of this project is to help the business understand:

- Why customers leave

- Who is more likely to churn

- Which customer segments are at risk

- What actions can reduce churn

This is a complete end-to-end data analytics project — from data cleaning to dashboard building to insight generation.

A telecom company is experiencing a high percentage of customer churn.

The management wants to understand:

- What drives customers to leave?

- Which locations and demographics have the highest churn?

- How do bill amount, satisfaction score, and tenure influence churn?

- What actions can reduce churn and improve retention?

This project aims to build an interactive Power BI dashboard to answer these questions clearly.

The client wanted answers to these:

- Which customer age groups churn the most?

- What are the top reasons for churn?

- Which locations have the highest churn?

- How does churn vary across age groups, payment methods, and service types?

- What is the average tenure and satisfaction score of churned customers?

- Do prepaid or postpaid users churn more?

- Which payment channels are linked to higher churn?

The dataset contains nearly 6,000 rows of data with the following columns:

- CustomerID — Unique customer identifier

- Churn_Status — Yes / No

- Age_Group — 18–25, 26–35, 36–50, 50+, Unknown

- Gender — Male, Female, Other

- Telecom_Circle — Customer location (state)

- Service_Type — Prepaid / Postpaid

- Payment_Method — UPI, Credit Card, Own App, Retail Store.

- Monthly_Charges — Monthly bill amount (numeric)

- Total_Charges — Lifetime bill amount (numeric)

- Tenure_in_Months — Months customer stayed (numeric)

- Customer_Satisfaction_Score — 1–5 rating

- Churn_Reason — Reason for leaving (if churned)

I cleaned the dataset using Excel and Power Query.

Below are the steps I followed:

- Removed leading & trailing spaces using

TRIM()/ Power Query Trim + Clean - Handled missing values:

- Payment_Method → filled with UPI (most common)

- Age_Group → Unknown

- Gender → Other

- Customer_Satisfaction_Score → filled with 3

- Churn_Reason → filled with other reasons if not mrntioned

- Telecom_Circle → ** if not mentioned Unknown**

- Dependents → No

- Fixed numeric issues:

- Removed

" Rs"text from numeric columns - Converted Monthly_Charges, Total_Charges, Tenure_in_Months to numeric

- Recalculated

Total_Charges = Monthly_Charges * Tenure_in_Months

- Removed

- Standardized categories for Service_Type, Payment_Method, Contract_Type

- Removed duplicates and invalid rows

- Loaded the final clean dataset into Power BI

Below are the key DAX measures used in the Power BI report:

Total Customers

Total Customers = COUNTROWS('Telecom Data')

Total Churned Customers

Total Churned Customers =

CALCULATE(

COUNTROWS('Telecom Data'),

'Telecom Data'[Churn_Status] = "Yes"

)

Churn Rate (%)

Churn Rate = DIVIDE([Total Churned Customers], [Total Customers], 0)

Avg Tenure of Churned Customers

Avg Tenure of Churned Customers =

CALCULATE(

AVERAGE('Telecom Data'[Tenure_in_Months]),

'Telecom Data'[Churn_Status] = "Yes"

)

Avg Monthly Charges of Churned Customers

Avg Monthly Charges of Churned Customers =

CALCULATE(

AVERAGE('Telecom Data'[Monthly_Charges]),

'Telecom Data'[Churn_Status] = "Yes"

)

Avg Satisfaction Score (Churned Only)

Avg Satisfaction Score of Churned Customers =

CALCULATE(

AVERAGE('Telecom Data'[Customer_Satisfaction_Score]),

'Telecom Data'[Churn_Status] = "Yes"

)

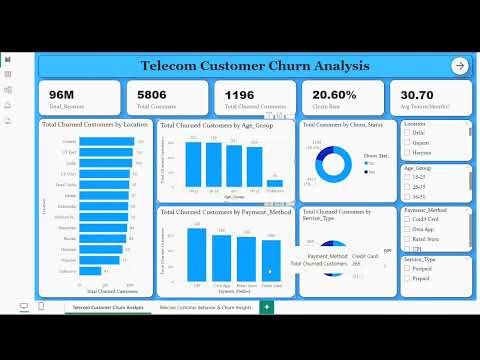

Answers:

- What is the overall churn rate?

- Which locations have the most churn?

- Do certain age groups churn more?

- Which payment methods and service types show higher churn?

Visuals:

- KPI Cards: Total Customers, Total Churned, Churn Rate, Avg Monthly Charges, Avg Tenure

- Donut: Churn Status breakdown

- Bar: Churn by Telecom_Circle

- Column: Churn by Age_Group

- Bar: Churn by Payment_Method

- Pie: Churn by Service_Type

- Slicers: Telecom_Circle, Age_Group, Payment_Method, Service_Type

Explores reasons and behaviors driving churn.

Visuals:

- KPI Cards: Avg Tenure (Churned), Avg Satisfaction (Churned), Avg Monthly Charges (Churned)

- Column: Tenure groups vs Churn count

- Column: Customer_Satisfaction_Score vs Churn count

- Column/Bar: Monthly_Charges bins vs Churn count

- Bar: Churn_Reason (sorted by count)

- Slicers: Telecom_Circle, Age_Group, Payment_Method, Service_Type

- Churn Rate ≈ 20.6% — Opportunity to improve retention.

- Age groups 26–35 and 36–50 show higher churn — target with retention offers.

- Top churn reasons: Network Issues, High Price, Wrong Recharge Issues, Poor Customer Service, Competitor Offers.

- Certain circles (Gujarat, UP East, Delhi) show higher churn — investigate network quality and competitor activity.

- Prepaid users show different churn patterns than postpaid; target onboarding and first-month offers.

- UPI / Own App users churn more than cash/retail-store users.

- Churned customers have lower avg satisfaction (~2.8) and shorter tenure — focus on early engagement.

Thank you for checking out my project. Feel free to reach out if you want collaboration.